How Long is Accounting School

How Long is Accounting School? Typically, earning a bachelor’s degree in accounting takes four years of full-time study. For those pursuing advanced education, a master’s degree usually requires an additional one to two years, while becoming a Certified Public Accountant (CPA) may involve further exams and experience requirements.

What is Accounting School

Accounting school is an educational institution or program where students learn the principles and practices of accounting. The curriculum typically includes courses in financial accounting, managerial accounting, auditing, taxation, and business law. Students are taught to analyze financial statements, manage budgets, and ensure compliance with regulatory standards.

In addition to technical skills, accounting school also focuses on developing analytical thinking and ethical decision-making. Graduates are prepared for various roles in public accounting, corporate finance, government, and non-profit organizations. Some programs also offer specializations, such as forensic accounting or international accounting, allowing students to tailor their education to specific career goals.

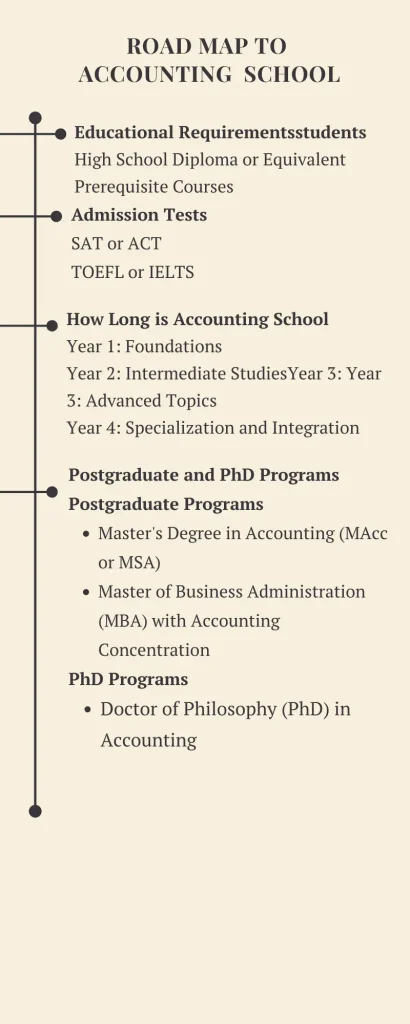

How Long is Accounting School

Year 1: Foundations

Introduction to Accounting: Basic principles and practices of financial accounting.

Microeconomics and Macroeconomics: Economic theories and their application.

Business Mathematics: Mathematical techniques used in business.

General Education Courses: Writing, communication, and other core requirements.

Year 2: Intermediate Studies

Intermediate Financial Accounting: In-depth study of accounting principles and financial reporting.

Managerial Accounting: Techniques for internal business management and decision-making.

Business Law: Legal environment of business.

Information Systems: Introduction to accounting information systems.

Year 3: Advanced Topics

Advanced Financial Accounting: Complex accounting issues and practices.

Auditing: Principles and practices of auditing and assurance services.

Taxation: Federal income tax laws and their application.

Cost Accounting: Analysis of cost behavior and cost management.

Year 4: Specialization and Integration

Accounting Electives: Specialized courses such as forensic accounting, international accounting, or governmental accounting.

Capstone Course: Integration of knowledge through a comprehensive project or case study.

Internship: Practical experience in an accounting setting.

Professional Ethics: Ethical considerations and responsibilities in accounting.

Upon completion, students are prepared to enter the workforce or pursue certification as a Certified Public Accountant (CPA) or further education with a master’s degree.

How to Enter Accounting School

Educational Requirements for Accounting School

High School Diploma or Equivalent: A high school diploma or GED is required.

Prerequisite Courses: Courses in mathematics, economics, and sometimes basic accounting.

Minimum GPA: Most programs require a minimum GPA, often around 2.5 to 3.0.

Entry Tests for Accounting School

SAT or ACT: Standardized test scores are typically required for undergraduate admission.

TOEFL or IELTS: For international students, proficiency in English may need to be demonstrated through these tests.

Application Process for Accounting School

Application Form: Complete the online or paper application form provided by the institution.

Transcripts: Submit high school transcripts or equivalent.

Letters of Recommendation: Typically, 2-3 letters from teachers or professionals.

Personal Statement: An essay detailing interest in accounting and career goals.

Application Fee: A non-refundable fee that varies by institution.

Financial Aids for Accounting School

Scholarships: Merit-based or need-based scholarships offered by the school or external organizations.

Grants: Federal and state grants such as the Pell Grant.

Student Loans: Federal student loans, private loans, and institutional loans.

Work-Study Programs: Part-time employment opportunities provided by the school to help cover expenses.

Financial Aid Application: Completion of the Free Application for Federal Student Aid (FAFSA) to determine eligibility for various types of financial aid.

Post Graduate and PhD Programs

Post Graduate Programs

Master’s Degree in Accounting (MAcc or MSA)

Duration: Typically 1-2 years.

Prerequisites: Bachelor’s degree in accounting or a related field; some programs may require prerequisite accounting courses if the undergraduate degree is in a different discipline.

Core Courses: Advanced Financial Accounting, Auditing, Taxation, Managerial Accounting, Accounting Information Systems.

Specializations: Forensic Accounting, Taxation, Financial Reporting, Audit and Assurance.

Capstone Project or Thesis: Many programs require a culminating project or thesis.

Master of Business Administration (MBA) with Accounting Concentration

Duration: Typically 2 years.

Prerequisites: Bachelor’s degree; work experience may be required for some programs.

Core Courses: Business Strategy, Corporate Finance, Managerial Accounting, Marketing, Leadership.

Accounting Concentration Courses: Advanced Accounting Topics, Financial Reporting, Auditing, Taxation.

Internship: Many programs include internship opportunities for practical experience.

PhD Programs in Accounting

Doctor of Philosophy (PhD) in Accounting

Duration: Typically 4-6 years.

Prerequisites: Master’s degree in accounting or a related field; some programs may admit students with a strong undergraduate background.

Core Courses: Advanced Financial Accounting Theory, Empirical Research Methods, Accounting Research Seminars, Economics, and Statistics.

Research Focus: Emphasis on original research, leading to a dissertation.

Comprehensive Exams: Required to demonstrate mastery of accounting theory and research methods.

Dissertation: Original research that contributes to the field of accounting.

Top 10 Accounting Schools

1. University of Texas at Austin – McCombs School of Business

Location: Austin, Texas

Highlights: Consistently ranked among the top, known for rigorous curriculum and excellent CPA exam pass rates.

2. University of Illinois at Urbana-Champaign – Gies College of Business

Location: Urbana-Champaign, Illinois

Highlights: Strong focus on research and practical application, with a high CPA exam pass rate.

3. Brigham Young University – Marriott School of Business

Location: Provo, Utah

Highlights: High job placement rates and strong alumni network.

4. University of Pennsylvania – Wharton School

Location: Philadelphia, Pennsylvania

Highlights: Prestigious program with a strong emphasis on financial accounting and managerial accounting.

5. University of Michigan – Ross School of Business

Location: Ann Arbor, Michigan

Highlights: Known for its comprehensive curriculum and strong connections to top accounting firms.

6. University of Southern California – Marshall School of Business

Location: Los Angeles, California

Highlights: Offers unique opportunities in forensic accounting and international accounting.

7. University of Notre Dame – Mendoza College of Business

Location: Notre Dame, Indiana

Highlights: High CPA pass rates and a strong focus on ethics and leadership.

8. Indiana University – Kelley School of Business

Location: Bloomington, Indiana

Highlights: Excellent placement rates and a variety of specializations in accounting.

9. University of Florida – Warrington College of Business

Location: Gainesville, Florida

Highlights: High CPA exam pass rates and a strong internship program.

10. New York University – Stern School of Business

Location: New York, New York

Highlights: Located in the financial capital of the world, offering unique networking opportunities and industry connections.

These schools are renowned for their rigorous academic programs, high CPA exam pass rates, strong industry connections, and excellent job placement rates for graduates.

Factors Affecting the Length of Accounting School

1. Type of Degree

Bachelor’s Degree: Typically takes 4 years of full-time study.

Master’s Degree: Usually requires an additional 1-2 years beyond the bachelor’s degree.

PhD Program: Can take 4-6 years, depending on the research and dissertation process.

2. Enrollment Status

Full-Time Enrollment: Enables students to complete their degrees within the standard time frame.

Part-Time Enrollment: Extends the time needed to graduate, as students take fewer courses per semester.

3. Prior Educational Background

Transfer Credits: Students with prior college credits or an associate degree may complete their program faster.

Prerequisite Courses: Additional time may be required if students need to complete prerequisite courses before entering the program.

4. Program Structure

Accelerated Programs: Some schools offer accelerated programs that allow students to complete their degrees in a shorter time.

Dual Degree Programs: These can extend the duration of study as students work towards two degrees simultaneously.

5. Internship and Practical Experience

Mandatory Internships: Required internships or co-op programs can extend the length of the degree, but they provide valuable practical experience.

Work-Study Balance: Students working while studying may take longer to complete their degree due to a reduced course load.

6. Certification Preparation

CPA Exam Requirements: Some programs integrate CPA exam preparation, which can add time to the overall duration if students take additional courses or preparation periods.

7. Personal and External Factors

Financial Constraints: Financial challenges may necessitate part-time study or breaks in education.

Life Events: Personal circumstances, such as family responsibilities or health issues, can impact the length of time required to complete the program.

Each of these factors can influence how long it takes to complete an accounting degree, varying the time from the standard duration to longer, depending on individual circumstances and choices.

Final Verdict

The length of accounting school varies based on degree type, enrollment status, prior education, program structure, internships, and personal circumstances. Understanding these factors helps prospective students plan their educational journey effectively, ensuring they meet their career goals within their desired time frame.

FAQs

1.How long does it typically take to earn a bachelor’s degree in accounting?

A bachelor’s degree in accounting usually takes four years of full-time study to complete.

2.What are the prerequisites for enrolling in a master’s program in accounting?

Prerequisites typically include a bachelor’s degree in accounting or related field and completion of specific accounting courses.

3.Can accounting degrees be completed part-time?

Yes, many programs offer part-time options, though this extends the time needed to graduate.

4.Are internships required for accounting degrees?

Many programs require or strongly recommend internships to provide practical experience, which can extend the program duration.

5.What factors can influence the length of time to complete a PhD in accounting?

Factors include research topic complexity, dissertation progress, and the student’s prior educational background, typically ranging from 4-6 years.